tesla tax credit 2021 washington state

Looking to get a model 3 but unfortunately live in WA state. Credits may be earned between January 1 2016 and January 1 2021.

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Tax credits are available on a first-in-time basis and are subject to annual limits of 2 million per weight class.

. Tesla owner caught a person replacing his car parts after renting it on Turo. They ended last year but were recently revived and will go into effect on August 1st of. Each entity may claim up to 250000 or credits for 25 vehicles per year.

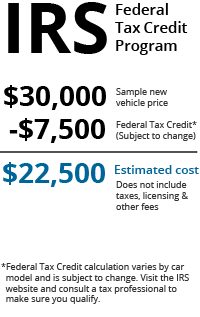

Other than tab fee and taxes it would just be the 1200 destinationdocumentation fee that Tesla charges but does not include in the configurator. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery. You can read our Special Notice Changes to Annual Tax Incentive Reports and Surveys for more information.

If you dont file reports due after July 1 2017 on time you will be billed 35 or 50 percent of the incentive you claimed. Washington credits fees - FAQ -. Create an additional 2500 credit for assembled in the US.

For used vehicles the price must be below 30000. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. HttpswwwdolwagovvehicleregistrationdocsVehicleFeespdf Reply E EVKANE Member Nov 30 2020 16 9 Seattle WA Dec 10 2020 7 My recent order shows 1125 destination fee and.

All credits earned must be used in that calendar year or the subsequent year. Place an 80000 price cap on eligible EVs. Discover more about state utility and local energy incentives here.

75 electrification fee also per year. The second document made further changes. IR-2022-110 May 25 2022.

On top of the initial 4000 tax credit you get an extra 3500 if the battery pack is at least 40 kilowatt-hour. Conditions and limitations apply. 150 state road fee in lieu of gasoline taxes also per year 3.

With the two added the EV credit you get is 7500. Posted by 5 days ago. Car tab cost 13 year based on MSRP - 50k 500 year 2.

After January 1 2020 the credit was completely phased out to 0 for new buyers. More posts from the TeslaModel3 community. Level 1 4 mo.

A refundable tax credit is not a point of purchase rebate. Tesla tax credit 2021 washington state. This means that any cars sold by GM and Tesla after May 24 2021 will be eligible for up to a 7500 tax credit.

From July 2019 through December 2019 the credit was reduced to 25. Teslas backlog of orders is currently more than our expected developer cap in all remaining. January 1 2023 to december 31 2023.

Latest On Tesla Ev Tax Credit March 2022. For Teslas this isnt a problem as the minimum is well over this threshold. In Washington new vehicles are subjected to a sales tax of 68.

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. The law can be read here. Could be state ones though.

Tesla tax credit 2021 washington state Tuesday May 24 2022 With this tax credit youd be getting a rebate on the sales tax you pay up to 2500 on new electric vehicles that cost less than. How are people able to justify the costs. At first glance this credit may sound like a simple flat rate but that is.

Who is eligible for the tax credit. So based on the date of your purchase TurboTax is correct stating that the credit is not available for your vehicle. Here is the WA state sales tax exemption form that can be used for purchasing charging equipment installation and EV batteries.

Beginning on January 1 2021. December 14 2021 Most people believe that a Tesla is out of their price range. WASHINGTON The Internal Revenue Service today revised frequently asked questions FAQs for the 2021 Earned Income Tax Credit FS-2022-30 to educate eligible taxpayers on how to properly claim the credit when they prepare and file their 2021 tax return.

And At this time the exemption goes thru 2020. If May 31 falls on a weekend or state holiday your due date is the next business day. With this tax credit youd be getting a rebate on the sales tax you pay up.

In the state of Washington EV tax incentives have been reinstated. New passenger cars light-duty trucks and medium-duty passenger vehicles that are dedicated AFVs and under 45000 are exempt from state motor vehicle sales and use taxes. The 200000 cap removal would be retroactive and applied to Tesla cars bought after May 24 2021.

If the cost of a new vehicle is 48000 and the value of your trade-in is worth 6000 you cant receive the tax exemption. Is there a federal tax credit for a Tesla purchased in 2022. However many states offer rebates and other incentives to buy electric vehicles or EVs.

If going into Tesla to purchase an extra UMC or WC bring the form with you. Washington State EV Tax Exemption. With prices starting at 35000 and going up to 124000 the brand is definitely in the aspirational range for a lot of people.

Here is the WA state sales tax exemption form that can be used for purchasing charging equipment installation and EV batteries. Families who dont owe taxes to the IRS can still file their 2021 tax return and claim the Child Tax Credit for the 2021 tax year at any point until April 15 2025 without any penalty. The Earned Income Tax Credit EITC helps low- to moderate-income workers.

The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. Tesla Tax Credit 2021 Washington State. The effective date for this is after December 31 2021.

Powerwall is designed to qualify for the Federal Investment Tax Credit ITC when it is installed on an existing or new solar system and is charged 100 with solar energy. Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. Tesla reached this mark in July of 2018 so the 50 credit phase out began in January 2019 and ran through the end of June 2019.

As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. Create an additional 2500 credit for union-made EV.

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Electric Vehicle Buying Guide Kelley Blue Book

How New Rebates Could Spur Widespread Adoption Of Electric Vehicles In Washington State Geekwire

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

2022 Washington State Ev Trends Electric Car Research

2022 Washington State Ev Trends Electric Car Research

Latest On Tesla Ev Tax Credit March 2022

/cloudfront-us-east-2.images.arcpublishing.com/reuters/H6Y6I2PVNFJ53PLNO3WBO7C3EY.jpg)

Elon Musk Can Afford Biden S Ev Snub Reuters

Latest On Tesla Ev Tax Credit March 2022

Tesla Solar Roof First Installation In Washington State Solar Electric Contractor In Seattle Wa 206 557 4215

Real Cost Of 2021 Tesla Model Y In Washington Still Worth It R Teslamodely

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Latest On Tesla Ev Tax Credit March 2022

Elon Musk S And Tesla S Cozy Government Relationships Gets Tested By Biden Administration The Washington Post

Tesla Could Access 7k Tax Credit For 400k More Evs Thanks To Green A

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The Station Elon S Tesla Share Sale Ford Teases A Second Ev Truck And Gm S Cruise Spending Ramps Techcrunch